The cTrader vs MT4 argument never ends, and frankly, most comparisons miss the point entirely. While traders debate features and interfaces, the real question is simple: which platform actually makes you money?

Both platforms operate within the massive global forex market, which churns through an average trading volume of $7.51 trillion per day. That’s more liquidity than you’ll ever need, but platform choice still determines whether you capitalize on it or get left behind.

MT4 dominates because it works. Over 25,000 Expert Advisors, universal broker support, and nearly two decades of proven performance. cTrader talks a good game with sub-millisecond processing and modern interfaces, but talk doesn’t fill trading accounts.

Here’s what actually matters: execution speeds, real-world automation capabilities, broker availability, and whether the platform helps or hinders your specific trading approach.

- Platform Overview: The Reality Check

- Interface and Usability: Style vs Substance

- Charting and Analysis: Tools That Matter

- Execution Speed: Where It Really Counts

- Automation: Community vs Technology

- Broker Support: Availability Determines Viability

- VPS Hosting: Performance That Matters

- Beginner Recommendations: Start Smart

- Direct Comparison: What Actually Matters

- The Verdict: Choose Based on Reality

- FAQ

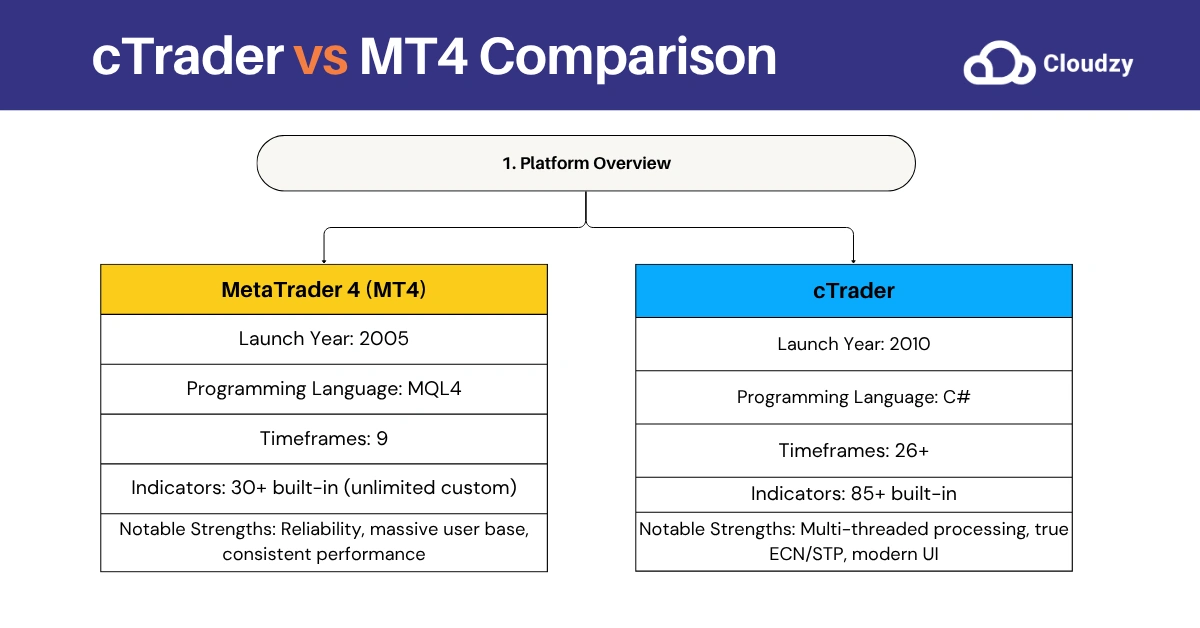

Platform Overview: The Reality Check

Every platform claims superiority. The market data tells a different story.

MetaTrader 4: Still the King

MT4 launched in 2005 and never looked back. Current data shows 85% of forex traders stick with MT4, and there’s a reason for that loyalty. MetaQuotes built something that simply works, day after day, year after year.

What MT4 Actually Delivers:

- MQL4 programming that millions understand

- 9 timeframes (enough for any serious analysis)

- 30+ core indicators plus unlimited custom options

- Over 3,006 servers worldwide

- Expert Advisors that actually function reliably

cTrader: The Challenger with Potential

Spotware launched cTrader in 2010 targeting MT4’s weaknesses. Fair enough. The platform does offer genuine improvements in specific areas, particularly for manual traders who prioritize interface design over raw functionality.

cTrader’s Real Advantages:

- C# programming (powerful but underutilized)

- 26+ timeframes (overkill for most traders)

- 85+ built-in indicators

- Multi-threaded processing

- True ECN/STP broker requirements

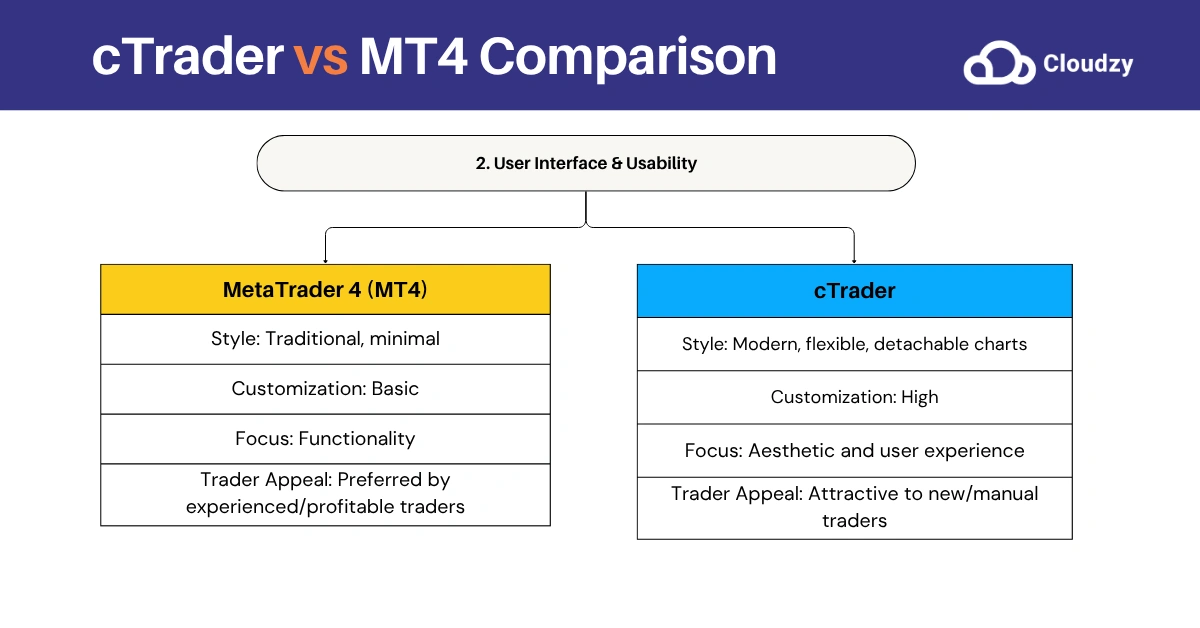

Interface and Usability: Style vs Substance

Your interface doesn’t execute trades. Your strategy does.

MT4: Function Over Form

MT4 looks dated because it is dated. So what? The interface gets out of your way and lets you trade. Market Watch shows prices, charts display data, Terminal manages positions. Everything works exactly as expected, every single time.

The customization options are basic, but here’s the thing – most profitable traders use simple setups anyway. Fancy interfaces don’t improve P&L.

cTrader: Pretty but Problematic

cTrader wins the beauty contest hands down. Detachable charts, modern design elements, flexible workspace arrangements – it’s genuinely impressive from a UI perspective.

But beautiful interfaces create a trap. New traders spend hours perfecting their setup instead of learning to trade. Advanced traders often prefer MT4’s no-nonsense approach that prioritizes function over aesthetics.

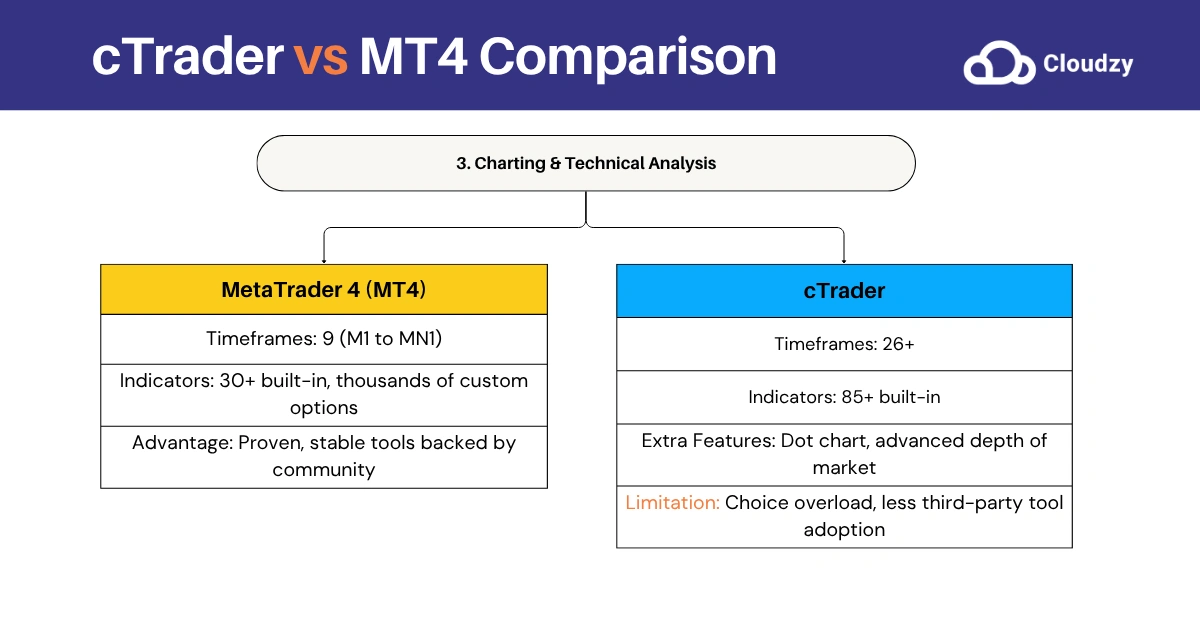

Charting and Analysis: Tools That Matter

Charts reveal market structure. The question is whether your platform helps you see what matters.

MT4: Proven Analysis Framework

MT4’s 9 timeframes cover everything from scalping (M1) to position trading (MN1). The 30+ built-in indicators handle most analysis needs, while MQL4 lets you build anything else.

The real advantage? Thousands of proven custom indicators developed over nearly 20 years. When you need a specific tool, it already exists and has been battle-tested by other traders.

cTrader: Feature Rich but Underutilized

cTrader’s 26+ timeframes sound impressive until you realize most profitable traders use 3-4 timeframes maximum. The 85+ built-in indicators create choice paralysis rather than clarity.

The dot chart and advanced market depth features are genuinely useful for specific strategies, particularly scalping and manual trading approaches that rely on order flow analysis.

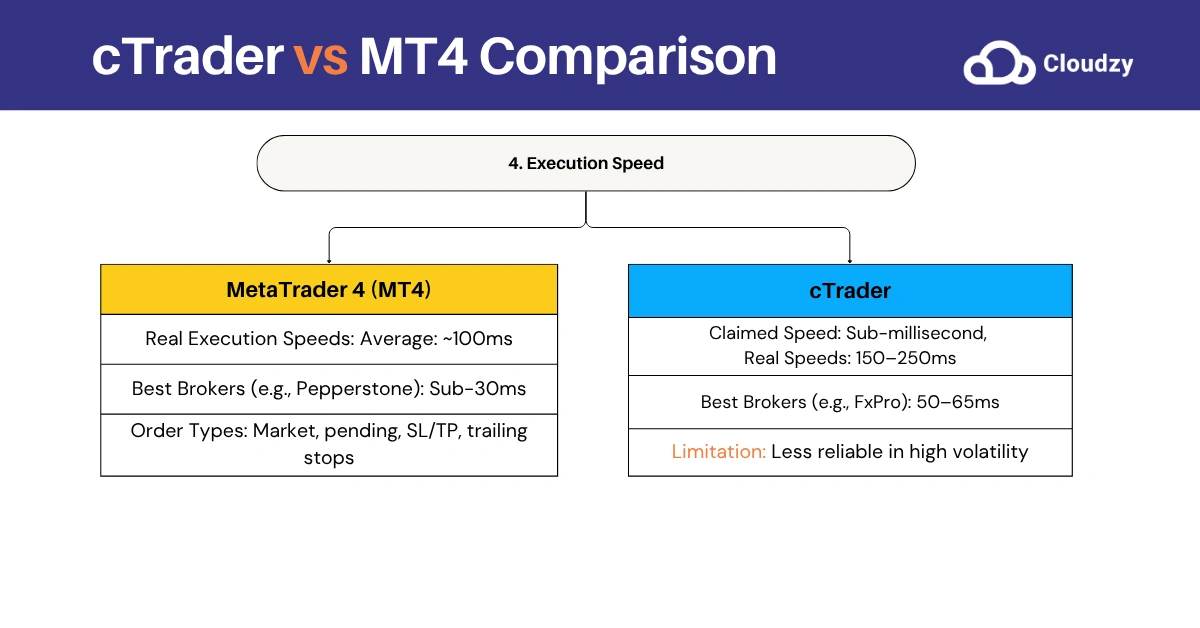

Execution Speed: Where It Really Counts

Speed matters, but context matters more.

MT4: Consistently Fast When It Counts

MT4 averages 100ms execution, but top brokers like Pepperstone deliver sub-30ms speeds. IC Markets hits around 40ms consistently. These aren’t theoretical numbers – they’re real-world performance from actual trading accounts.

MT4 Order Management:

- Standard market and pending orders

- Reliable stop loss and take profit execution

- Trailing stops that actually work (when platform stays connected)

cTrader: Theoretical Speed vs Real Performance

cTrader claims faster execution but typically delivers 150-250ms in practice. Leading brokers like FxPro can achieve 50-65ms, but that’s still slower than MT4’s best performers.

The proxy servers and latency reduction features sound great on paper. In live trading, especially during high-impact news, MT4 often executes faster and more reliably.

Reality Check: Experienced scalpers consistently report better fills on MT4, despite cTrader’s marketing claims about speed advantages.

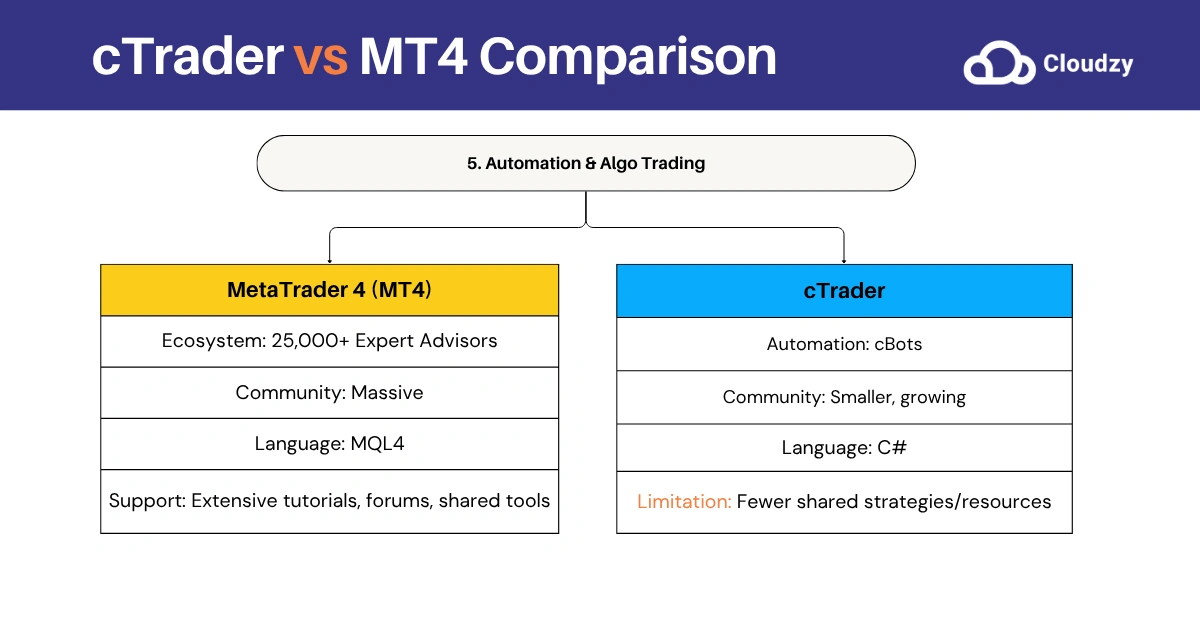

Automation: Community vs Technology

Algorithmic trading success depends on available tools and community support, not programming language elegance.

MT4: Massive Ecosystem Advantage

25,000+ Expert Advisors exist because MT4 worked when others didn’t. The MQL4 community has spent two decades building, testing, and refining automated strategies.

You want a specific EA? It exists. You need a custom indicator? Someone already built it. You have a programming question? Thousands of developers can help.

This isn’t about MQL4 being superior to C#. It’s about critical mass and community support that no other platform matches.

cTrader: Better Technology, Smaller Community

C# is objectively more powerful than MQL4. cBots can theoretically do more than Expert Advisors. The Open API enables sophisticated integrations.

But here’s what kills cTrader for serious algo traders: community size. When you need help, resources, or proven strategies, the cBot ecosystem feels empty compared to MT4’s vast library.

Hard Truth: Most traders would rather use proven MQL4 solutions than build custom C# strategies from scratch.

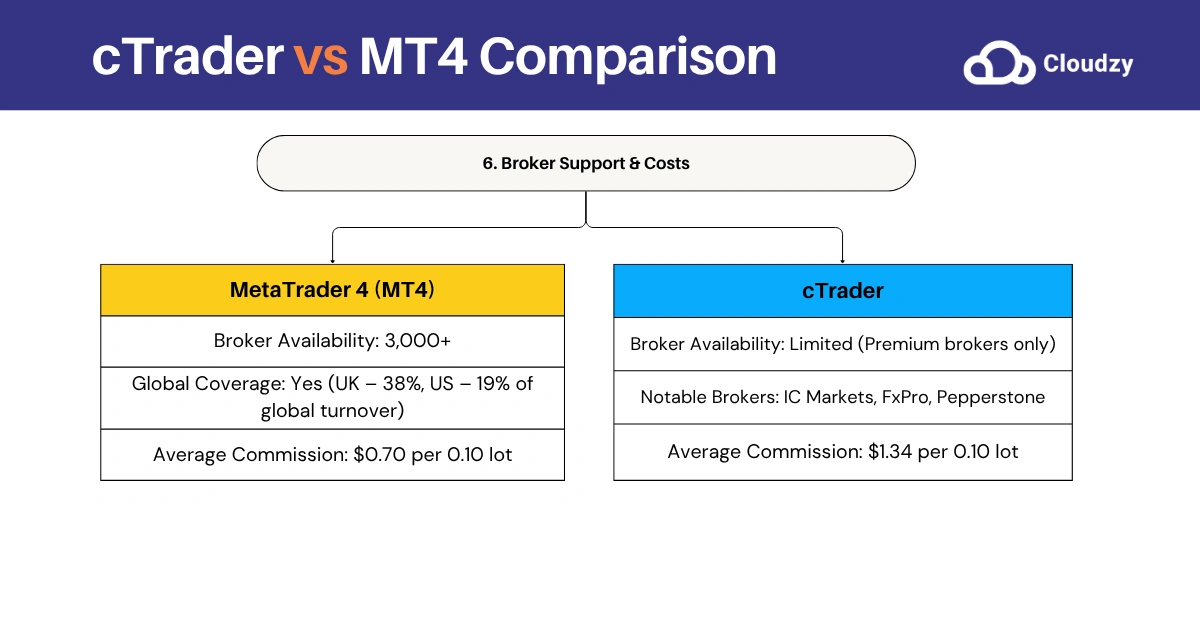

Broker Support: Availability Determines Viability

Platform features don’t matter if you can’t find a good broker.

MT4: Universal Compatibility

Every serious forex broker offers MT4. That’s over 3,000 brokers worldwide, spanning every regulatory jurisdiction and trading condition imaginable.

The UK handles 38% of global turnover, the US manages 19%, and virtually every major broker in these markets supports MT4. Universal availability means competitive spreads and diverse account options.

cTrader: Limited but Quality Options

cTrader’s broker selection reads like a “who’s who” of premium brokers: IC Markets, FxPro, Pepperstone, Fusion Markets, BlackBull Markets. These are solid choices, but the selection remains limited.

Cost Reality: Testing reveals cTrader commissions often run higher – $1.34 per 0.10 lot compared to MT4’s $0.70 for equivalent positions. That difference adds up fast for active traders.

VPS Hosting: Performance That Matters

Network latency kills trading performance. VPS hosting fixes this problem for both platforms.

Cross-connected VPS setups achieve 0.33ms latency to London and 0.37ms to New York data centers. At those speeds, only broker execution matters – network delays disappear entirely.

Professional setups require enterprise-grade hosting. MT4 VPS solutions deliver sub-millisecond connections to major financial centers with guaranteed uptime. For remote access needs, Forex RDP provides full Windows environments optimized for serious trading.

Beginner Recommendations: Start Smart

Platform choice shapes your learning curve.

MT4: The Obvious Choice for New Traders

MT4’s learning resources dwarf every competitor. Thousands of tutorials, extensive community forums, and universal broker support create an ideal learning environment.

New traders need simplicity and support, not advanced features they can’t use effectively.

cTrader: Beautiful but Challenging

cTrader’s modern interface appeals to new traders, but the limited broker selection and smaller community create unnecessary obstacles during the crucial learning phase.

The transparency features are genuinely valuable, but beginners need proven educational resources more than advanced order flow tools.

Direct Comparison: What Actually Matters

| Aspect | MT4 | cTrader |

| Real Execution Speed | 30-100ms (proven) | 50-250ms (variable) |

| Available Timeframes | 9 (sufficient) | 26+ (excessive) |

| Indicator Library | 30+ built-in, unlimited custom | 85+ built-in, limited custom |

| Broker Availability | Universal (3,000+) | Limited (dozens) |

| Automation Support | Massive community | Growing but small |

| Commission Costs | Lower ($0.70/lot) | Higher ($1.34/lot) |

| Learning Resources | Extensive | Limited |

The Verdict: Choose Based on Reality

Pick MT4 If You:

- Want proven reliability over theoretical advantages

- Need extensive automation options and community support

- Prioritize broker choice and competitive costs

- Prefer substance over style

Pick cTrader If You:

- Value modern interfaces and advanced charting

- Focus on manual trading strategies

- Don’t mind limited broker selection

- Want built-in transparency features

Bottom Line: cTrader offers superior technology for specific use cases, particularly manual trading and scalping. MT4 provides better overall value through universal compatibility, lower costs, and massive community support.

Most traders succeed better with MT4’s proven ecosystem than cTrader’s advanced features. Choose based on your actual needs, not marketing promises.

For serious performance optimization, learn how to install MT4 on VPS to eliminate latency issues that affect both platforms.