CFDs offer direct market exposure with leverage but unlimited loss potential, while options provide defined risk for buyers but with time decay affecting premiums. Your choice depends on risk tolerance, trading style, and capital requirements.

The decision between CFD trading vs options isn’t just about which instrument looks more appealing on paper. It’s about finding the right fit for your strategy, risk appetite, and trading goals.

Both markets show significant growth:

- Options trading reached record levels of 108.2 billion contracts traded globally in 2023

- 43% of retail investors now actively use leverage through instruments like CFDs and options

For intermediate traders exploring advanced instruments, this comparison cuts through the marketing noise. We’ll examine execution requirements, risk profiles, and real-world scenarios. Understanding the [What is CFD Trading | Beginners’ Guide to Financial Trading] fundamentals provides essential context.

- CFDs vs Options: What’s the Difference?

- What Are the Risk Profiles You're Really Getting Into?

- What Execution Speed Do You Actually Need?

- Which Trading Strategies Fit Your Style?

- What Do These Instruments Actually Cost?

- What Platform Requirements Matter Most?

- How Should You Make Your Decision?

- Conclusion

- FAQ

CFDs vs Options: What’s the Difference?

| CFDs (Contracts for Difference) | Options Contracts | |

|---|---|---|

| What it is | A deal with your broker to trade based on price changes | A contract that gives you the right to buy/sell later |

| Ownership | No ownership of the asset | No ownership, just a right to trade |

| How it works | Like borrowing money to trade more than you could with cash | Like buying insurance to protect or benefit from price moves |

| Risk | Can lose more than you invested | You only lose the premium (the amount you paid) |

| Profit Potential | Unlimited gains, but also high risk | Can make high returns with limited loss |

| Time Limit | No expiration | Expires after a set time (e.g., 30 days) |

| Money Needed | Only a small deposit (margin) is required | Must pay the full premium up front |

| Difficulty | Simple and easy to understand | More complex, with more factors to consider |

| Real-Life Example | Pay $1,500 to control $15,000 in Apple stock (10:1 leverage). Gain/loss of $1,000 if price moves $10 | Pay $300 for a call option to buy Apple at $155. Gain $700 if price goes to $165 |

| If Price Drops | Lose $1,000 or more | Only lose the $300 premium |

The fundamental difference lies in ownership structure and obligation. CFDs create a direct contractual relationship with your broker, while options grant rights without obligations for buyers.

Think of it this way: CFDs are like borrowing money to buy more of something you believe will go up in price. Options are like paying for insurance that gives you the choice to buy or sell later if conditions are right.

Real-World Example: Let’s say Apple stock trades at $150. With CFDs, you might put down $1,500 to control $15,000 worth of Apple shares (10:1 leverage). If Apple rises to $160, you make $1,000 profit. But if it drops to $140, you lose $1,000 – potentially more than your initial deposit.

With options, you might pay $300 for the right to buy Apple at $155 within 30 days. If Apple hits $165, you can buy at $155 and immediately sell at $165 for $1,000 gain (minus the $300 premium). If Apple stays below $155, you only lose the $300 premium – nothing more.

Key distinctions that affect your trading:

- Risk exposure: CFDs can lose more than you invest; options limit buyer losses to premium paid

- Profit potential: CFDs offer unlimited upside; options provide leveraged gains with defined maximum loss

- Time sensitivity: CFDs have no expiration; options lose value as expiration approaches

- Capital requirements: CFDs need margin deposits; options require full premium upfront

- Complexity: CFDs are straightforward; options involve multiple variables affecting price

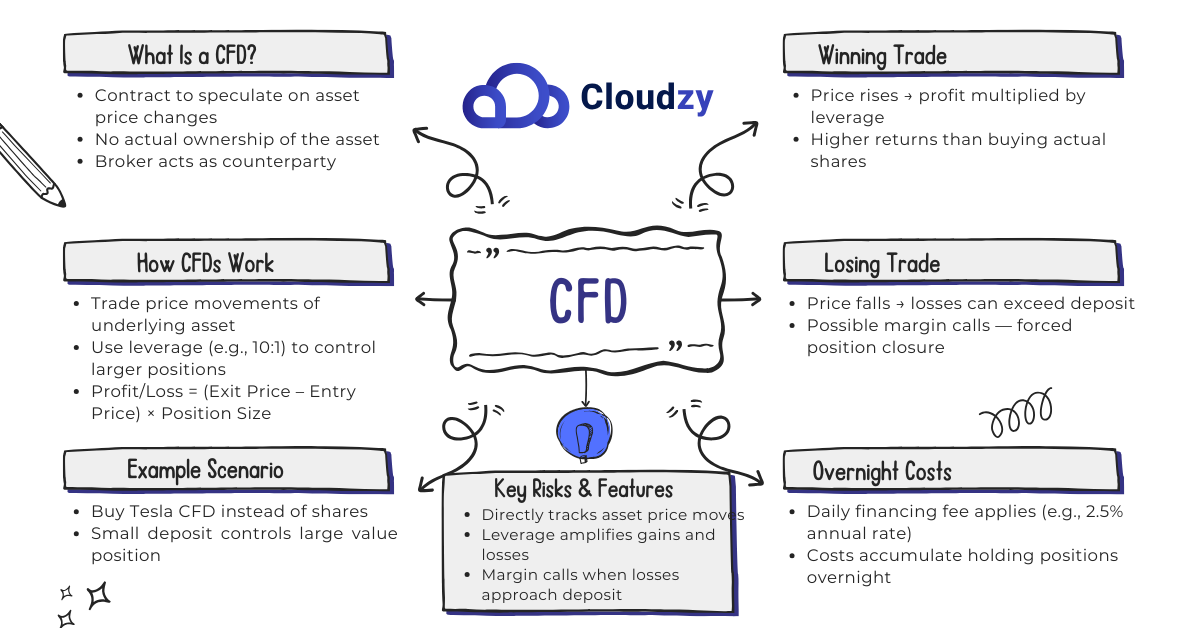

How Do CFDs Work in Practice?

CFDs mirror the underlying asset’s price movements without requiring ownership. When you open a CFD position, you’re speculating on price direction with your broker as the counterparty.

Simple CFD Example: Imagine you think Tesla stock will rise from its current $200 price. Instead of buying 100 actual Tesla shares for $20,000, you open a CFD position. With 10:1 leverage, you only need $2,000 to control the same $20,000 position.

Scenario 1 – Winning Trade: Tesla rises to $220. Your profit = ($220 – $200) × 100 shares = $2,000. That’s a 100% return on your $2,000 deposit, compared to just 10% if you bought the actual shares.

Scenario 2 – Losing Trade: Tesla drops to $180. Your loss = ($180 – $200) × 100 shares = -$2,000. You’ve lost your entire deposit, and if it drops further, you owe more money.

What Happens Overnight: If you hold Tesla CFDs overnight, you pay a small daily fee (usually around 2.5% annually). For a $20,000 position, that’s about $1.37 per day. This adds up over time.

Core CFD mechanics explained:

- Profit/loss calculation: (Exit price – Entry price) × Position size = Your gain or loss

- Direct price tracking: If Tesla moves 5%, your CFD moves 5% – no complex calculations needed

- Leverage amplification: 10:1 leverage means 1% price move = 10% account impact (both ways)

- Overnight costs: Daily financing fees accumulate when holding positions beyond market close

- Margin calls: If losses approach your deposit, brokers may close positions automatically

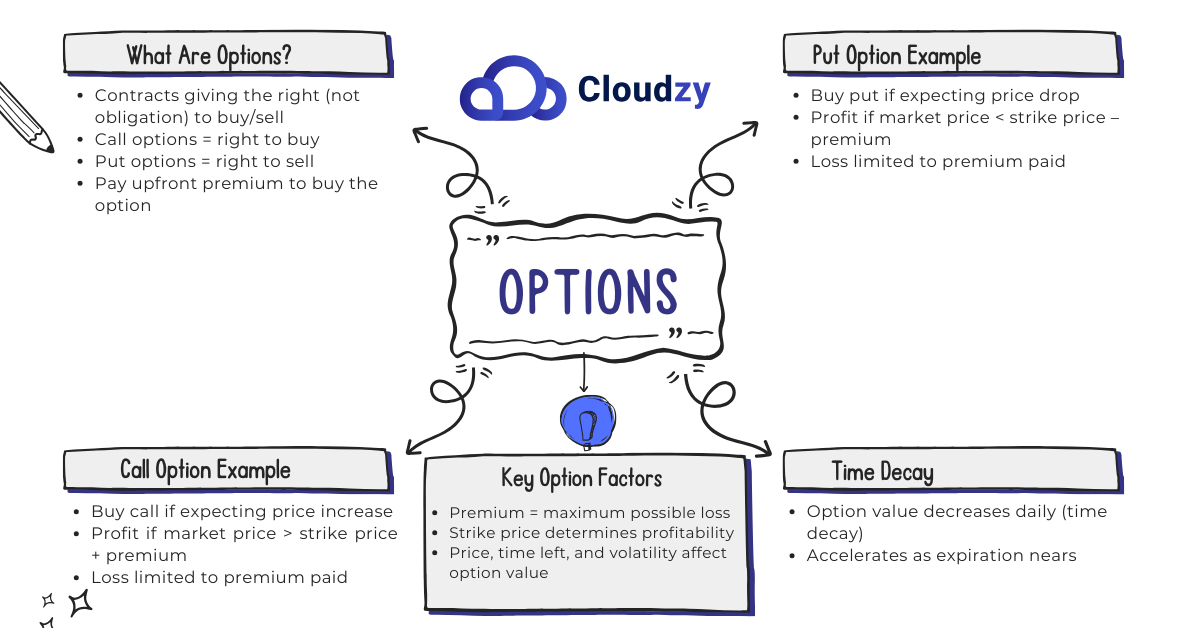

How Do Options Work Fundamentally?

Options contracts grant the right (not obligation) to buy or sell an asset at a predetermined price within a specific timeframe. Call options provide buying rights; put options provide selling rights.

Simple Call Option Example: You believe Amazon stock (currently $100) will rise before Christmas. You buy a call option with a $105 strike price expiring in 30 days, paying a $3 premium per share. For 1 contract (100 shares), you pay $300 total.

Scenario 1 – Amazon rises to $115: You can buy Amazon at $105 (your strike price) and immediately sell at $115 market price. Profit = ($115 – $105 – $3 premium) × 100 = $700. Your $300 investment became $1,000.

Scenario 2 – Amazon stays at $100: Your option expires worthless since buying at $105 when market price is $100 makes no sense. You lose only the $300 premium you paid – nothing more.

Put Option Example: You think Netflix (currently $200) will drop. You buy a put option with a $195 strike price for $4 premium, paying $400 total.

If Netflix drops to $180: You can sell Netflix at $195 (your strike) when market price is $180. Profit = ($195 – $180 – $4 premium) × 100 = $1,100.

Time Decay Reality: That $3 Amazon premium shrinks daily. With 30 days left, it might lose $0.10 per day. With 5 days left, it could lose $0.50 per day as time runs out.

Essential options features explained:

- Premium as maximum loss: You can never lose more than what you paid upfront ($300 in Amazon example)

- Time decay acceleration: Options lose value faster as expiration approaches, like melting ice

- Strike price importance: Determines if your option has value (Amazon must exceed $105 for profit)

- Multiple factors: Price movement, time remaining, and market volatility all affect option value simultaneously

What Are the Risk Profiles You’re Really Getting Into?

The difference between cfd and options risk structures determines which instrument suits your trading psychology and capital situation.

What CFD Risk Factors Can’t You Ignore?

CFDs carry significant risks that traders must understand:

- Unlimited loss potential – No cap on losses if markets move against you

- Gap risk – Weekend gaps or news events can trigger losses exceeding account balance

- Margin calls – Force position closures when equity falls below maintenance requirements

- Overnight financing costs – Daily charges accumulate and impact longer-term strategies

- Broker counterparty risk – Your broker is the direct counterparty to every trade

How Does Options Risk Structure Work?

Options provide different risk characteristics depending on your position:

For Options Buyers:

- Limited loss (premium only) provides predictable maximum risk

- Time decay accelerates as expiration approaches

- Implied volatility changes affect prices independently of underlying moves

For Options Sellers:

- Assignment risks create obligations to deliver or purchase underlying assets

- Unlimited loss potential for naked positions

- Margin requirements for maintaining short positions

What Execution Speed Do You Actually Need?

Platform capabilities and execution quality directly impact trading results. Understanding speed requirements helps avoid costly delays during critical market moments.

Research shows only 1.6% of traders achieve consistent profitability, making execution quality crucial for success.

CFD Execution Requirements:

- Sub-second execution speeds for scalping strategies

- Real-time pricing feeds during high-volatility periods

- Stable platform connectivity during market gaps

Options Execution Needs:

- Sophisticated order management for complex pricing relationships

- Simultaneous execution for multiple leg strategies

- Advanced analytics for Greeks calculations

VPS Solutions for Both:

- Metatrader VPS hosting maintains CFD platform uptime and reduces latency

- NinjaTrader VPS hosting ensures complex options orders execute without internet disruptions

- Consistent execution quality during volatile periods

Slippage Differences:

- CFDs experience slippage during news events

- Options slippage occurs in wide bid-ask spreads during low liquidity

Which Trading Strategies Fit Your Style?

Strategy alignment determines long-term success more than instrument choice. Matching your approach to the right tool prevents fighting against natural characteristics.

Understanding short-term vs long-term trading instruments helps optimize strategy selection based on holding periods.

What CFD Strategies Work Best?

Day Trading and Scalping:

- Direct price exposure with tight spreads

- No time decay allows holding positions for minutes or hours

- Quick entry and exit capabilities

Swing Trading:

- Works when managing overnight financing costs

- Positions lasting several days to weeks need cost calculation

- Suitable for trending markets

Short-Selling Opportunities:

- Profit from falling markets as easily as rising ones

- Understand borrowing costs and dividend adjustments

- Both directional capabilities

How Can You Apply Options Strategies?

Hedging Applications:

- Protective puts limit downside while maintaining upside potential

- Insurance-like protection for existing portfolios

- Risk management tool for long-term investments

Income Generation:

- Covered calls and cash-secured puts for conservative traders

- Generate premiums while maintaining positions or cash reserves

- Consistent income in sideways markets

Directional Strategies:

- Long calls or puts for significant expected moves

- Require accuracy in both direction and timing

- Limited risk with leveraged exposure

What Do These Instruments Actually Cost?

Understanding true trading costs prevents surprises that turn profitable strategies into losers. Hidden fees and financing charges often exceed expectations.

When comparing CFD trading vs options costs, remember options buyers pay upfront while CFD costs accumulate over time.

CFD Cost Structure:

- Spreads: 0.1 pips for major forex pairs to several dollars for individual stocks

- Overnight financing: Daily compound charges for held positions

- Commission variations: Some charge commission plus tight spreads, others embed costs in wider spreads

Options Cost Breakdown:

- Premiums: Include intrinsic value plus time value components

- Commissions: Typically per-contract fees

- Bid-ask spreads: Wider during low liquidity periods

Hidden Cost Factors:

- Leverage impact on overnight financing

- Time decay acceleration near expiration

- Slippage during volatile periods

What Platform Requirements Matter Most?

Platform capabilities often determine strategy feasibility more than market knowledge. Understanding technology requirements helps prevent costly technical failures.

CFD Platform Essentials:

- Real-time pricing feeds and instant order execution

- Advanced charting and risk management tools

- Automated trading capabilities

- Review Best CFD Trading Platforms for comprehensive comparisons

Options Platform Needs:

- Complex pricing models and sophisticated analytics

- Greeks calculations and volatility analysis

- Multi-leg order management capabilities

- Advanced strategy testing tools

Professional Trading Resources:

- Best prop firms provide enhanced platforms and increased capital access

- Specialized firms typically focus on either CFDs or options

- Better execution quality and professional tools

Infrastructure Considerations:

- VPS hosting eliminates internet connectivity issues

- Crucial for leveraged positions during volatile periods

- Maintains consistent execution quality

| Factor | CFDs | Options |

| Risk Profile | Unlimited loss potential | Limited loss for buyers |

| Capital Requirements | Margin-based (5-20%) | Premium payment upfront |

| Time Sensitivity | No time decay | Time decay affects positions |

| Complexity Level | Moderate | High (multi-leg strategies) |

| Execution Needs | Speed-critical for scalping | Complex order management |

| Cost Structure | Spreads + overnight financing | Premiums + commissions |

How Should You Make Your Decision?

Decision frameworks help cut through analysis paralysis by focusing on practical factors that matter most for your situation.

Risk Tolerance Assessment:

- If unlimited loss potential concerns you, options buying provides better sleep

- CFD trading suits active risk management and position monitoring comfort

- Consider your emotional response to potential losses

Capital Availability Factors:

- CFDs require less upfront capital due to leverage

- Options need full premium payment but offer defined maximum loss

- Calculate total capital requirements including margin buffers

Trading Timeframe Considerations:

- Short-term strategies favor CFDs (no time decay)

- Longer-term directional plays might benefit from options’ leveraged exposure

- Match instrument characteristics to your holding period preferences

Additional Comparisons:

- Explore CFD trading vs futures for instrument alternatives

- Consider CFDs vs Stocks for traditional investment comparisons

- Ensure platform supports your chosen instrument’s execution requirements

Conclusion

The choice between CFD trading vs options ultimately depends on your risk tolerance, trading style, and capital situation. CFDs offer direct market exposure with flexible holding periods but require active risk management due to unlimited loss potential.

Options provide defined risk for buyers but introduce time decay complexity and require precise timing. Successful traders often use both instruments strategically: • CFDs for short-term directional plays • Options for hedging or income generation • Focus on mastering one instrument before expanding

Your execution infrastructure matters as much as market knowledge. Whether you choose CFDs or options, ensure your platform and internet connectivity support your strategy’s requirements during volatile periods.